The sharp change in consumer end demand has also affected the overall supply and demand performance of the semiconductor market this year.

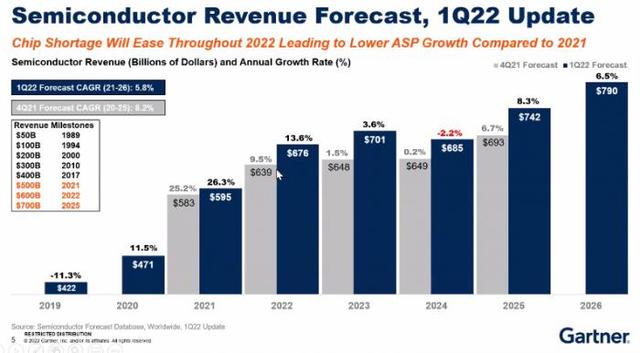

According to Gartner, the global semiconductor market revenue rose 26.3% last year, due to the imbalance between supply and demand, but a larger proportion was due to the price increase of semiconductor devices.With the downturn in the biggest semiconductor demand side, including smartphones, this year, the semiconductor market will be driven mainly by upstream price increases this year, which the agency expects to decline by 2023 and could enter an industry recession in 2024.However, the continued changes in external factors, or may accelerate the arrival of a recession period.

Sheng Linghai, vice president of Gartner Research, told the 21st Century Business Herald that although the overall market, especially in specific areas, the relatively strong —— demand is concentrated in the industrial and automotive sectors.But in fact, since the second half of last year, the semiconductor market has begun to oversupply some products, mainly in communications, mobile phones and other fields.

For the domestic semiconductor industry, in the general market rise, the threshold of domestic Top is also rising, in the global supply system, the domestic semiconductor role still has a large room for growth.

Part of the oversupply

The year 2021 is undoubtedly a bumper harvest year for the semiconductor market. Major chip companies at home and abroad have gained rapid growth in performance, and "repeated new highs" emerge in an endless stream.

However, with the previous production capacity in place, the demand side is tightening, and the external environment continues to change, the semiconductor market may gradually move to the other side of the cycle.

Sheng Linghai analyzed that the growth of the global semiconductor market in 2021 mainly comes from two aspects: the rebound in the demand side, such as cars, smartphones, data centers and other markets; the greater driver comes from the unit price rise, that is, the continuous price growth of many devices due to the supply shortage, such as power devices, network chips and 4G chips.

"So last year's 26.3% growth last year does not mean a surge in semiconductor or consumer electronics consumption, but a large part of a rise in ASP prices.We forecast a 13.6% semiconductor market revenue growth in 2022, but it may not be that big, based on the demand side."He continued that this year, the main driver of semiconductor market growth will remain from unit price growth from some supply shortages.

(Global Semiconductor Revenue forecast, updated as of quarter 12022, Source: Gartner)

It is generally believed in the industry that since the second half of 2021, the supply shortage of main chips on the mobile phone end has been significantly eased, and the demand shortage mainly comes from general devices such as MCU and power management chips.

Sheng linghai told reporters that in the first half of last year, some companies have begun to hoard goods to some extent for the supply shortage.This leads to a rise in demand in the short term and drives the price rise, but when the inventory reaches a certain water level, the purchase volume decreases, leading to a subsequent drop in price. ——, that is, the seasonal supply and demand imbalance caused by the supply problem, typically in the memory industry.

"At present, some chips are already overloaded, including the older generation of 5G chips, some RF front-end chips, CIS (image sensor chips), mobile phone memory, mobile phone-related DDI (display driver chips), and some low-threshold consumer chips."He continued, and the demand related to industry applications, industry and automobiles remains strong, from the product categories, including analog chips, MCU, power management and so on are still popular."It should be said that the entire semiconductor market has shifted from structural out of stock to specific areas out of stock.”

Of course, due to the relatively complex supply chain links of the semiconductor industry, the price adjustment still needs time to bring about by the change in supply and demand, leading to the current upstream impulse to rise.

Seek a higher breakthrough

With tight supply and continuous changes in the external environment, the "multi-supplier" strategy has become a common decision for back-end manufacturers.In this context, domestic manufacturers previously difficult to enter the industrial chain also ushered in a round of introduction and development opportunities.

At the same time, domestic manufacturers in the recent years of entrepreneurship and financing wave, have also consolidated or adjusted the boundary of capacity, showing a rapid rise in the performance level.

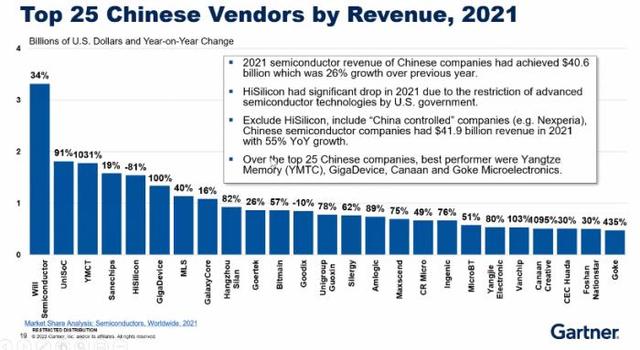

A decade ago, the revenue threshold for domestic Top10 semiconductor manufacturers was about $200 million, but by 2021, the threshold had risen to nearly $500 million.Under the birth of the market last year, the vast majority of companies grew rapidly.

(Top25 revenue for Chinese semiconductor manufacturers in 2021, data source: Gartner)

For example, in the main chip, radio frequency devices, MCU, multimedia chip and other fields, domestic manufacturers have better seized the introduction of development opportunities.However, it should be pointed out that the import is only the first step, and if the subsequent capabilities or services cannot continue to follow up, there is still a risk of being eliminated.

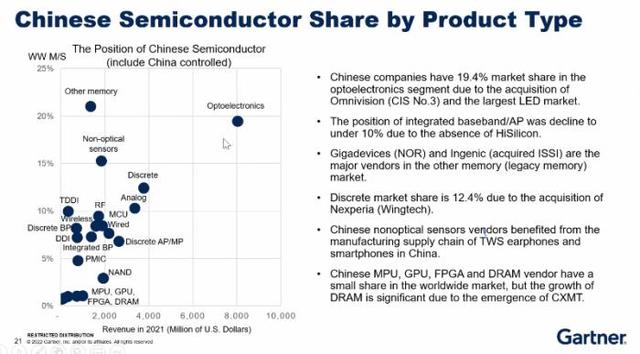

It is also worth paying attention to the market share of domestic manufacturers, at present, there is still a large room for growth.

Gartner believes that occupying more than 10% of the market share means that there is a certain voice or dominance of the industry.Some head manufacturers in domestic vertical fields have achieved a certain position through endogenous development and extension expansion, but overall, not many products occupy more than 10% of the position.

Sheng Linghai introduced, according to statistics, the current domestic share in more than 10% of the field including CIS and LED, NAND Flash (flash memory), analog chips, etc.However, there are more concentrated in the 5% -10% range, including MCU, DDI, AP (power amplifier), etc.In the fields below 5%, GPU, FPGA, DRAM, etc., with higher research and development difficulty and entry threshold. The development of these fields requires not only profound chip itself, but also to build a relatively rich semiconductor industry ecology.

(Market share of Chinese semiconductor companies by product type, data source: Gartner)

He further pointed out, " In the past, domestic manufacturers mainly entered the market at low cost, participate in low-dimensional competition, and now grow to a certain extent, the challenge is to no longer win more markets through the 'following model'."So for domestic semiconductor companies, the first thing to find a way to achieve their own market share of more than 10%, and then consider whether to continue to get more revenue in the market segment, or another track development.

"Domestic semiconductor development opportunities also have something to do with the domestic supply chain.For example, mobile phone communication and consumer electronics, the domestic supply chain has an absolute advantage, then the most opportunity; then I think there is a great opportunity in the automotive and industrial fields, especially the industry has national standards, but cars are relatively in the initial stage."He continued, at present there are many semiconductor companies are actively into the automotive supply chain, but gauge itself threshold is higher, verification and import time is longer, but with oems also actively invest in semiconductor companies, forming the industry linkage, hope to be able to see the development of domestic gauge chip, it also need oems to actively embrace.

For Chiplet (small chip / core particle), which has attracted much attention due to the failure of Moore's Law, Shenglinghai told reporters that the current redefined Chiplet is to connect different high-speed chips and transform the PCIe interface between chips into silicon chip connection mode, but no one can do this at present.

"Advanced packaging does not represent Chiplet. It should be said that Chiplet has a smaller range of definitions than advanced packaging.Generally, if you want to do Chiplet, such as now Apple, Nvidia, AMD, Intel to do a lot of related products, all using advanced technology.However, the domestic can not achieve advanced technology, if TSMC does Chiplet, the cost is still high, the mobile phone chip has not used this technology, the 2.5D package Apple uses is not Chiplet; according to the narrow definition of Chiplet, most applications are still in the high price, high cost applications, such as data center."He analyzed.

Source: 21st Century Economic Daily